LandOrc

Defining the Future of Real Estate and Blockchain

#LandOrc $LORC #DeFi #NFTs, #Realty #Property #Landtitle #staking.

What is LandOrc?

A blockchain enabled ecosystem that allows seamless movement of capital and collateral between investors, property developers and land title owners.

Providing, security, transparency and enabling the growth of real estate industry thru lower cost of capital. Converting land titles into Non Fungible Tokens (NFT) allow for ease of tracking transactions and process of using them as a collateral. The LandOrc platform integrates data both on-chain and off-chain, including data linked to location, vicinity and visuals of the land via oracles integrated to the chain. Using the principles of Decentralized Finance (DeFi) Digital Asset Owner can participate in the global real estate projects with active returns and security of land based collateral.

Headquartered out of United Arab Emirates and with technology and operations teams spread across multiple geographies.

LandOrc uses an operating model involving special purposed vehicles (SPV) domiciled within each of the operating markets. This ensures that process of lending and managing collaterals are done within the legal framework of the jurisdiction.

What's in it for the Investor?

A large portion of Digital Asset Owners are looking for longer term gains, reflected in the 99% of Ethereum wallets that are not invested in higher risk DeFi transactions. Investors have an opportunity to participate in the global real estate industry from a single platform gaining attractive staking reward while having the security of land as collateral. With all transactions on the Blockchain, Digital Asset Owner benefit from transparency and security.

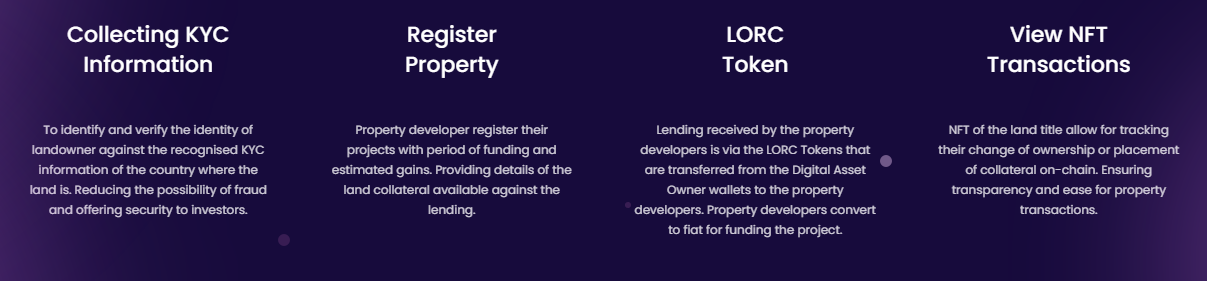

Collecting KYC Information

Identifying and verifying the identity of investor using blockchain based identity solutions to ensure compliance with investment norms.

Investment

Investors stake their crypto investments on projects in the platforms with target rate of staking reward and fixed period of time. Investment is secured by collateral of higher value for greater security.

Stake LORC token

All stacking is done via LORC token which is bought using digital assets at exchanges. Returns post investment period are credited back to investor wallets in the way of LORC tokens.

What's in it for the Landowner?

Property developers are challenged in terms of raising capital, especially those operating in high staking reward geographies. The recent pandemic has put greater pressure on banks and other conventional sources. Access to capital at a lower staking reward rate would reduce cost of financing and increase profits. The blockchain based solution ensures that the financing process is secure and faster than the conventional solutions.

Technology

Land NFT Tokens (LandNFT)

Non-Fungible Token, based on the ERC-721 standard of Ethereum. It represents a digital form of the land title. LandNFT enables storage of verified data and eases property transaction and collateralisation via trackable movement across wallets on the blockchain.

LandOrc Tokens (LORC)

Utility token based on ERC20 standard provides Digital Asset Owners the means for staking on property development projects available on LandOrc platform. Using smart contracts to provide assured staking rewards over the defined period and with an underlying land title collateral available via NFT.

Land Governance Tokens (LGOV)

LGOV allow members of the LandOrc ecosystem – property developer, lawyers, valuers, Digital Asset owners and technology partners to vote on key decisions on the platform. Distributed proportionately across members with specific allocated voting rights and multi signature wallet for independent valuers and legal counsels, to ensure adequate oversight. Minimum threshold vote amongst all issued LGOV tokens is needed to allow a property development project to be made available for staking on the plaform.

Roadmap

2020

Advisory, Consultancy, Partnership, Clients

Q1 2021

Client Onboarding India & Africa Locations

Q2 2021

Seed Funding

Technology Partnership

Formalise Market Planning

Proof of Concept Development

Q3 2021

LandOrc Beta Launching

Launch of private financing round

Staff of marketing initiatives for Eastern Europe

Mint 200 land title NFT

Q4 2021

LORC token sale

Launching in DEX-Uniswap

Listing of token in multiple exchange

Launch 20 property development project & Scale up to Africa

Q1 2022

Hybrid Connector allows Interoperability

Launch Latin America

Q2 2022

Expansion to rest of high interest market globally

Q3 2022

Upgrade legal Consensus

Expanding legal partnerships

Q4 2022

Expand to more Exchange

Teams

Damodharan V: Chief Executive Officer, Global operations

Daniel: Advisor, Marketing

Greg Duffell: Advisor, Market Entry, SEA

Peng Yew (PY): Advisor, Real Estate Industry

Manoharan S: Chief Executive Officer, India operations

Jason LIM: Senior Data Analyst (Real Estate)

Suresh Naidu: Advisor, Innovation & Communication

Prakash Mathavan: Advisor, Finance Management

Sree Murthi: Chief Technology Officer

Navonil Roy: Principal Advisor

Nick Low: Advisor, Technology

Herdetya: Design & Dev

Ahmad: Animator

Andra Ann: Project Coordinator

Praveena Premakumar: Senior Manager Operations

Mirza Mahfuza: Project Management

For More Information Click Links Bellow:

- Website: https://landorc.io/

- Telegram: https://t.me/joinchat/ECZFCDv8DPY0ODk1

- Facebook: https://www.facebook.com/LandOrc.io/

- Twitter: https://twitter.com/LandOrc1

Author:

Tomohoon https://bitcointalk.org/index.php?action=profile;u=3198788

Komentar

Posting Komentar